Empowering Private Equity

to build their proprietary

deal origination and monitoring platform

John Farrugia

CEO, Cavendish

Charles-Hubert Le Baron

Partner, Astorg

Shai Hill

Former Head of Research, Macquarie Bank

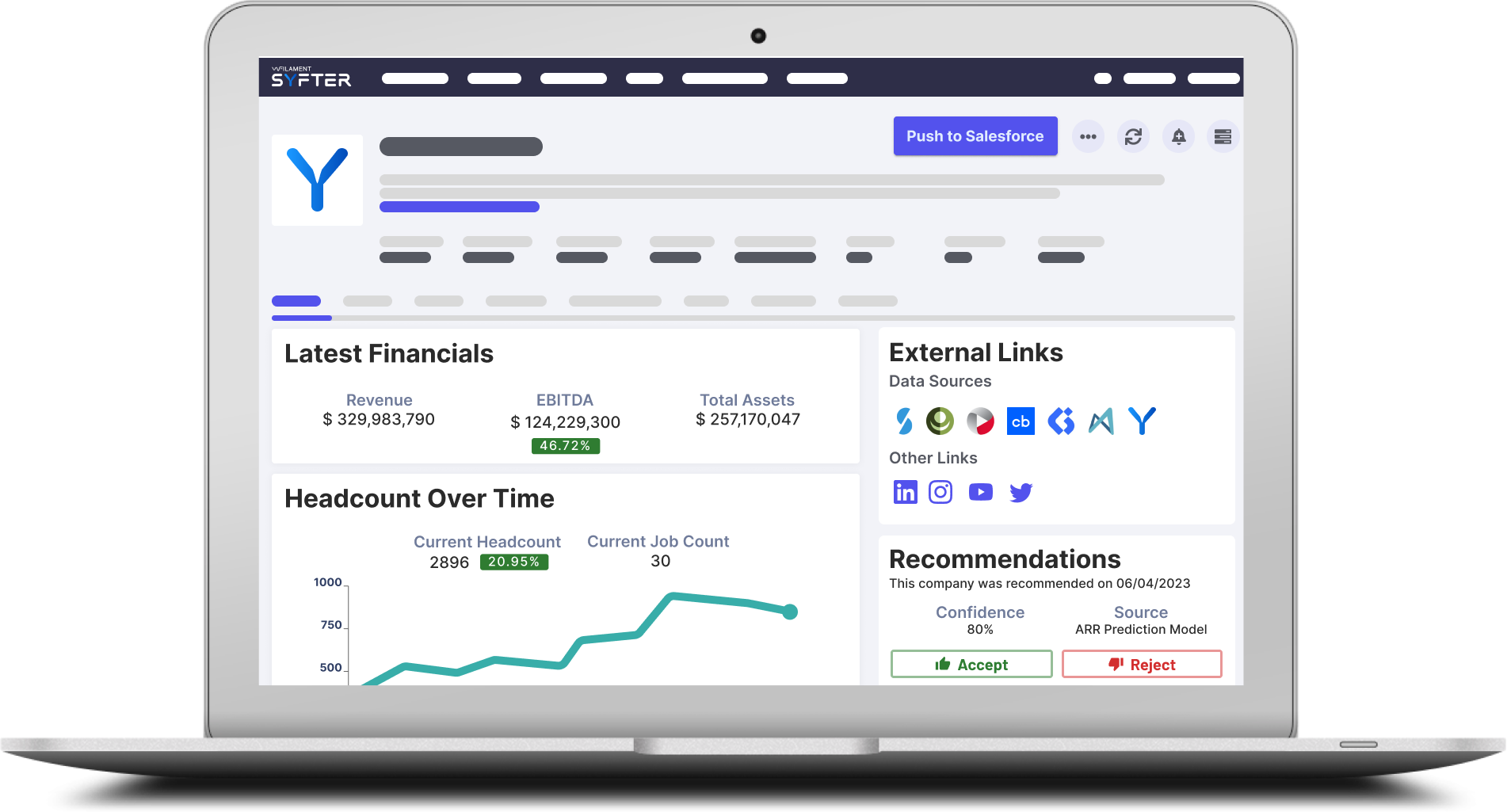

Syfter is our award-winning white-labelled integration platform for Private Equity and Corporate Finance, enabling firms to originate new deals 24/7 and keep their finger on the pulse. With over six years of relentless problem-solving and experience supporting the world’s best firms, we have productised the data infrastructure needed to provide unique market intelligence to every firm. This includes the data integrations, database structure and user application.

Live CRM Updates

We monitor your CRM and help keep it up-to-date with fresh data

Data management & governance

Data Management Solutions for Private Equity Firms: Elevate Your Strategy with Filament Syfter

Monitoring

Empowering Private Equity Firms with Advanced Market Intelligence

Deal sourcing & origination

Private Equity Origination Solutions: Revolutionize Deal Sourcing with Filament Syfter

AI and Predictive Modelling

AI and Predictive Modelling in Private Equity: Unleashing Data-Driven Insights

Market mapping

AI-Powered Company Similarity Search for Private Equity

Mergers & Acquisitions

Private Equity M&A: Optimizing Acquisition Strategies for Portfolio Growth

More product features include:

Weekly Deal Emails

We power the most important email of your week with personalised insights for each member of your firm

360 View

Integrate all your internal and external data into a single, unified view

Pre-built connectors to favourite data sources:

Integrate all your current data subscriptions and internal data sources into Syfter to create the most powerful company profiles. We are proud to be partnered with S & P Capital IQ, Sourcescrub and Valu8

Recent Awards

Winners of Best AI Product in the FS/Fintech category!

This recognition is a testament to our incredible team's hard work, dedication, and innovation. We are immensely proud of what we've achieved, and this award reaffirms our commitment to pushing the boundaries of the use of AI in private market investment. It's a true honour to be recognised alongside some of the brightest minds in the industry.

Winners of the "Emerging Tech Company of The Year" South Coast Tech Awards by The Business Magazine

Receiving this award underscores our commitment to pushing the boundaries of technology, and it’s a testament to the remarkable innovation that our company has brought to the forefront of the Fin Tech industry. We are genuinely humbled to be recognised for our groundbreaking technology that holds the potential to revolutionise the private equity market.

Shortlisted for the Private Equity Wire European Emerging Managers Awards 2023

We are delighted to announce that we have been shortlisted for the prestigious Private Equity Wire European Emerging Managers Awards 2023 in the category 'Best New Solution'. We very much appreciate the continued support of our friends and colleagues as we continue to work hard to assist our clients with building their proprietary AI platform.

Implement a proprietary data platform within weeks, not months.

Implementing Syfter hugely accelerates your time to value. Here are the steps involved

Step 1

Syfter is deployed as an empty database within your firewall

Syfter securely implements an empty database within your organisation’s firewall; this ensures that all data processed and stored within Syfter remains protected and under your control.

Step 2

Choose the one million companies you want to track

In this step, you will have the opportunity to choose and prioritise the one million companies that are most relevant to your business goals. These companies will be tracked and monitored closely by Syfter to provide you with valuable insights.

Step 3

Activate the third-party data sources that you use within your firm

Enable the integration and activation of your preferred third-party data sources, empowering your organisation with a holistic view of market trends, industry news, and relevant information that aligns with your business requirements.

Step 4

Integrate your internal data via your CRM

Bi-directional integration capabilities with leading CRM and Sharepoint systems to guarantee a single source of truth. Consolidate and unify internal data sources, enabling a comprehensive analysis of your internal data alongside external information for more accurate insights.

Step 5

Apply custom scoring on companies & news via rules or machine learning

Tailor customised scoring to companies and news articles, ensuring that the relevance and importance of information align with your unique business needs, utilising either predefined rules or advanced machine learning techniques.

Step 6

Be alerted to new opportunities and key events around your companies of interest

Receive timely alerts and notifications about emerging opportunities and significant events related to your tracking companies; stay proactive and make informed decisions based on the latest developments in your industry.

Filament Syfter empowers our clients to

integrate, interrogate and enrich heterogeneous market data

to operationalise knowledge in an investment firm.

Integrate

Elect the top one million firms that align with your organisation’s strategic focus, ensuring your resources are dedicated to tracking the most relevant and impactful entities. Seamlessly curate an intricate mosaic of diverse data sources, utilising Syfter’s advanced data integration capabilities. This allows you to achieve unparalleled market coverage, providing depth of insight and breadth of understanding rarely seen in the industry. At Syfter, we place emphasis on precision.

Our platform ensures a rigorous data disambiguation process, mapping the correct information to the appropriate company profile within your database. In doing so, we alleviate inaccuracies and ambiguities, presenting you with a reliable and refined data landscape. Trust Syfter to elevate your private equity intelligence, offering an enhanced lens through which you can view and interpret the private market sector.

Interrogate

Refine and adjust the signals you wish to scrutinise, catering to analysts, managers, and partner use cases. Utilise Syfter’s state-of-the-art analytic capabilities and workflow management tools designed specifically for the intricate demands of private equity intelligence.

With Syfter, you’re not just working with data – you’re navigating a labyrinth of third-party pipelines, bringing them seamlessly into one platform with our state-of-the-art matching, and helping your team foster a nuanced understanding of any industry by leveraging machine learning and ai to create custom scoring mechanisms and investment evaluation techniques rooted in your firm’s investment thesis. which you can view and interpret the private market sector.

Enrich

Maintain the functionality of your CRM as a management tool for your extensive network of up to 20,000 business relationships. Integrating Syfter at the crux of your data pipeline revives and rejuvenates your CRM system by infusing it with a constant stream of live, curated data. This enrichment process harnesses the capabilities of Syfter, transforming your CRM from a static repository into a dynamic, data-enriched engine, powering your private equity intelligence with precision and nuance.